Dive Into the World of Bitcoin!

Welcome to your Bitcoin knowledge base. Whether you’re just starting to explore what Bitcoin is or you’ve already begun your journey into decentralized currency, this resource has something for everyone.

Let’s address the noise first: Bitcoin is not a cult, scam, fake currency, ponzi scheme, or pyramid scheme. It’s not destroying the environment or consuming all the world’s electricity. In fact, it’s quite the opposite of these claims. But here’s the important part: you should question those who make these accusations, and you should also question those of us who deny them. Don’t trust, verify.

So how does Bitcoin actually work? Why is it dominating headlines, and what makes it so revolutionary? From blockchain fundamentals to how it’s transforming global finance, we’re here to make even the complex concepts simple and engaging.

Let’s explore together and discover how Bitcoin is creating a path toward financial freedom and innovation.

Essential Terms and Definitions

A

Adoption Curve: Generally speaking, the first 15% is a slightly rising ramp that takes “x” amount of time, the middle 70% happens in roughly the same amount of time, and the last 15% are those that join simply because it exists and has been proven.

B

Bitcoin Adoption Curve: When Bitcoin first had “value,” you couldn’t even buy a gumball with 1 Bitcoin. Eight years in, you could buy a really nice riding lawnmower with 1 Bitcoin. Now you can buy a home with 1 Bitcoin. And this is still the “slightly rising ramp” of the adoption curve. The next 16 years are going to be very interesting.

Bitcoin Will Die: Bitcoin has been declared “dead” over 430 times by various authorities, experts, and media outlets. Many of those same people are now racing to acquire as much Bitcoin as they can. Track every Bitcoin obituary since 2010 at Bitcoin Deaths.

BTC: The abbreviation is accepted worldwide for Bitcoin. Don’t forget folks, the orange one is the only one that matters.

D

DCA (Dollar Cost Averaging): No different than putting $X per week into a savings or retirement account. Nobody who has used this strategy for 5 consecutive years with Bitcoin has lost value. Most exchanges are set up so you can do this daily for as little as $10.

E

Epoch: The Bitcoin protocol started on January 3, 2009, beginning the first Epoch. Each Epoch consists of 210,000 “blocks” being created and takes approximately 4 years to complete.

G

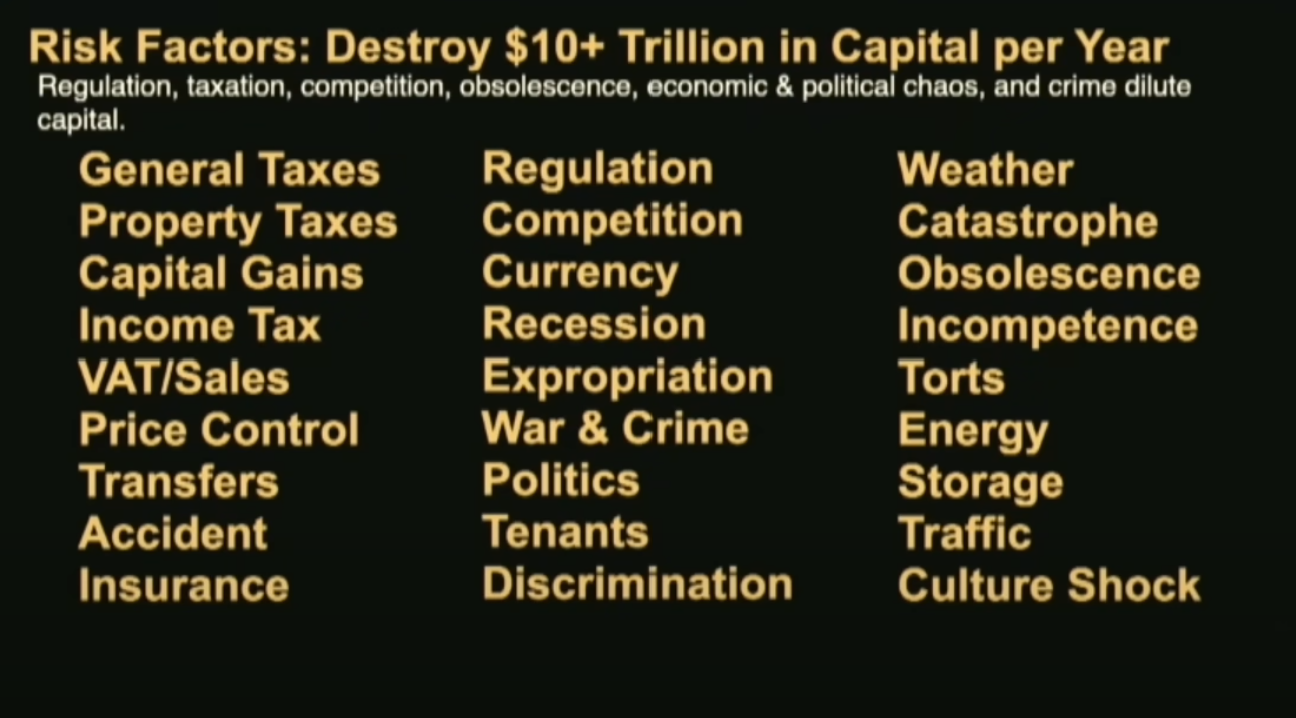

Global Money Supply: All currencies combined (Dollars, Euro, Yen, etc.) increases an average of nearly 7% each year. From 2000 to Q2 2024, the global broad money supply grew from $26.5 trillion to $129.3 trillion. From February 2020 to June 2021 alone, it grew 21%. The USD supply surged 40% from January 2020 to January 2022.

H

Halving: Epoch 1 generated 50 BTC roughly every 10 minutes for a total of 10,500,000. Each next Epoch generates half as many Bitcoin. Epoch 2 generated 25 BTC for a total of 5,250,000. Epoch 3 generated 12.5 BTC for a total of 2,625,000, and so on. We are currently in Epoch 5, which started on April 19, 2024, generating 3.125 BTC roughly every 10 minutes.

L

Limited Supply: Nothing on the planet, especially in the world of finance and assets, has a truly limited supply like Bitcoin. We are currently creating Bitcoin at a slower rate than we are mining gold. While Bitcoin is programmed to mine less each Epoch, if the price of anything else rises (gold, milk, housing), we will mine more gold, produce more milk, and build more houses. More than 19,800,000 Bitcoin are currently in circulation. In 2026, there will be 20,000,000 BTC created, and it will take over 100 years for the final 1,000,000 to be created.

M

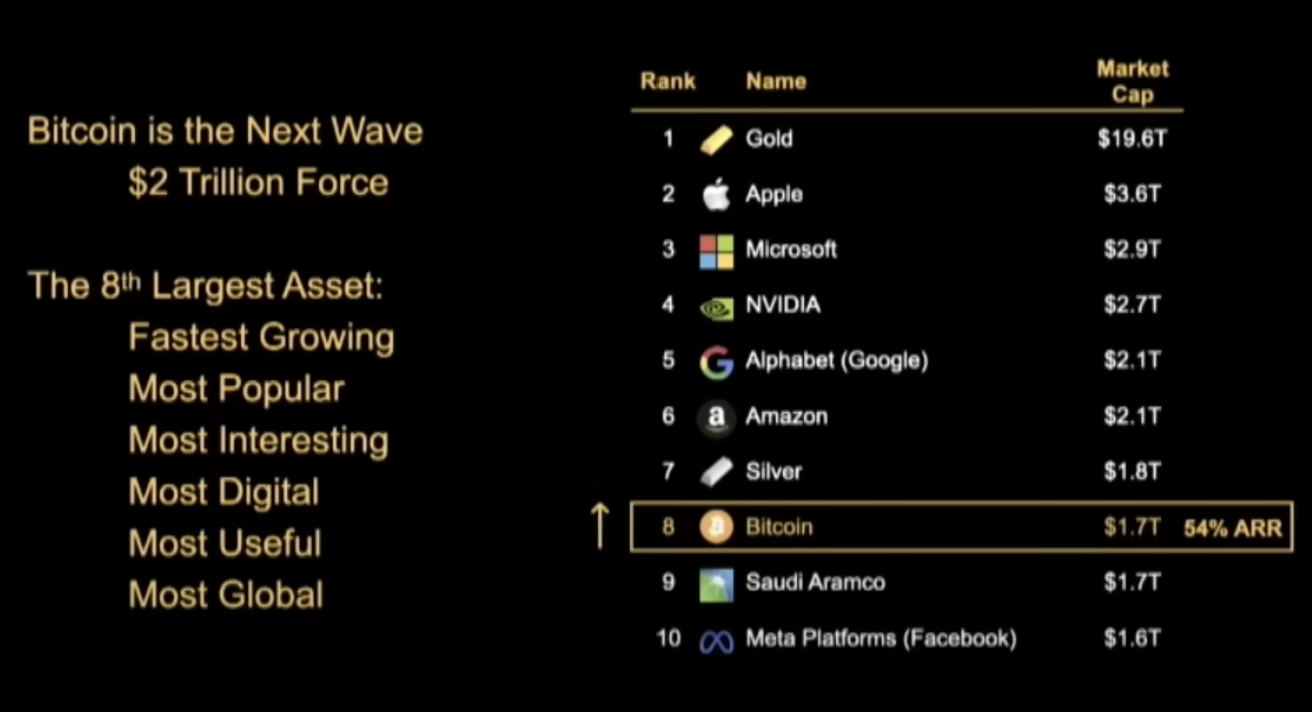

Magnificent 7: Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Nvidia (NVDA), Meta Platforms (META), and Tesla (TSLA). At least one of those companies owns Bitcoin. Another one has 2 goats named Max and Bitcoin.

Mining: It’s not really mining. In layman’s terms, computers running the protocol solve and process verifiable transactions and package them into a perfect mathematical “block.” The first “miner” to create a verifiable block is given a “block reward” of Bitcoin. It takes approximately 10 minutes to create a block. Miners are currently rewarded with approximately 450 new Bitcoin per day, while large corporations and asset managers (over 200 at time of writing) are currently acquiring roughly 5,000 per day.

O

OG: “Old guy” or “original gangsta” – someone who has been in a space since the early days.

R

Risk: Google it yourself. What is the best performing asset over the past 10 years? Then spend some time researching at caseBitcoin.com.

S

Satoshi: (Person) Satoshi Nakamoto released the White Paper for the Bitcoin protocol to the world on January 3, 2009, free to anyone who wanted to try it. While “he/she/they” is what you’ll usually hear, the truth is nobody knows for sure who Satoshi is. But there’s been plenty of speculation.

Satoshi: (Unit) The smallest unit of a Bitcoin. A single BTC is divided into 100,000,000 Satoshis. While many appreciate the gesture to honor the “founder,” it can get confusing and even seem cultish to newcomers. There’s even a movement to rename the smallest unit. Some suggest 100,000,000 BITS make up 1 BTC instead.

V

Volatility: Three of the Magnificent 7 companies are more volatile than Bitcoin (Bloomberg, 3/15/2024).

W

Wallet: This has nothing to do with leather or designer bags. Bitcoin wallets are all about function and security, with many options available. Some are fine for replacing the amount of cash you carry or spending limits you’re comfortable with, carrying similar risks. Others serve as savings and retirement account replacements. You can also choose personal vault options never connected to the internet, protected by memory, titanium plates, or security protocols. At some point in your journey, you’ll likely decide to take control of your personal or family finances. Ideally, you’ll reach out to professionals at thebitcoinway.com before reaching that point.

Peer-to-Peer Payment Systems

At its base and core, Bitcoin is designed to be a peer-to-peer payment system and an incredible pathway to “bank the unbanked.” This means you can send money directly to anyone, anywhere in the world, without needing permission from banks, governments, or payment processors. For the billions of people worldwide who have access to traditional banking services, Bitcoin provides a way to store value, send remittances to family, and participate in the global economy using just a smartphone and internet connection. The system works 24/7, has no minimum account balances, and doesn’t require credit checks or identification beyond what you choose to provide. This revolutionary concept was first outlined in The Bitcoin White Paper, which details how this peer-to-peer electronic cash system can function without trusted third parties.

Why is Bitcoin incredibly successful as an “investment” and “store of value”?

Because it’s being adopted at an incredible rate for what it was designed to be: a peer-to-peer payment system. The price appreciation isn’t speculation or hype—it’s the natural result of a revolutionary technology being recognized and adopted by individuals, corporations, and even governments worldwide. As more people understand Bitcoin’s utility as censorship resistant money, demand increases while supply fixed at 21 million coins. Major corporations are now adding Bitcoin to their balance sheets as a treasury asset, recognizing its superior monetary properties compared to traditional stores of value like cash or bonds. This institutional adoption Bitcoin’s design and creates upward price pressure as these companies compete for a limited supply. You can track which major companies are leading this adoption at BitcoinTreasuries.net, which shows the top Bitcoin treasury companies and their holdings. The “number go up” phenomenon is simply the market pricing in Bitcoin’s inevitable role as the world’s premier digital money.

Stay up to date on the important “bits”…

Join our email list to receive our newsletter.

Looking for help? Get in touch with us