I WANT YOU TO KNOW…

I WANT YOU TO KNOW…

The truth is fascinating and, more importantly, verifiable. We’ve tried to keep it brief, simple, and even a little entertaining.

The truth is fascinating and, more importantly, verifiable. We’ve tried to keep it brief, simple, and even a little entertaining.

This isn’t about politics, wealth, race, religion, or nationality. Bitcoin doesn’t care if you’re male or female, lawyer or laborer, parent or child, patriotic or sovereign, educated or a dropout, boomer or millennial. It works the same for everyone, regardless of background or beliefs.

Bitcoin only cares about one thing: that the rightful holder is authorizing their coins to move. Where you send them, how much, and why is your business. Most of us just want to pay bills, buy necessities, and save what we can.

Here’s the truth: cash remains the dominant tool for criminal activity. Anyone telling you otherwise is simply lying. Bitcoin’s transparent blockchain makes it easier to track transactions than traditional cash ever could.

Bitcoin is financial freedom for everyone. The question isn’t whether you qualify, it’s whether you’re ready to take control.

You may very well be — and if so, it’s completely understandable. It’s not your fault. Even if you don’t think you are, that’s equally understandable — and still not your fault. The reality is, many people find themselves in that position without even realizing it.

Jack Mallers is a standout figure in the industry. With a strong foundation, including a father with a background in the financial sector, Jack had early exposure to the importance of networks and insight. Today, he leads with a refreshingly unconventional approach — often seen in a hoodie, he founded Strike, a Bitcoin-only exchange known for low fees and high limits. He’s also now at the helm of Twenty One Capital. His perspective offers a compelling explanation of the current landscape — Check out Strike for more information.

If you believe you have a solid understanding of the financial system — and that includes asset managers responsible for personal or corporate retirement funds — I encourage you to examine this video and evaluate its content on a factual basis.

James is a highly respected voice in the industry. His clear, measured communication style and commitment to evidence-based insights make this an excellent resource. He effectively connects the dots between the traditional financial system and the evolving world of Bitcoin.

It’s easy to take for granted the relative stability many of us experience in the U.S.—though even that sense of security is worth questioning. Tony’s commitment to Bitcoin emerged not from curiosity, but from necessity. Faced with devastating circumstances, he chose to learn, adapt, and lead. Today, he embodies the core principles of Bitcoin, supported by the remarkable team he’s built at www.thebitcoinway.com.

Tony has made it his personal mission to help others avoid the hardships he endured and to prepare them for what many believe is an inevitable shift in the financial landscape.

Supply

21 Million Strong: Exploring Bitcoin’s Fixed Supply

There will only ever be 21,0000,000 Bitcoin.

With ~22 million U.S. millionaires, there aren’t enough Bitcoins for each to own just one.

If every person on the planet owned an equal share of Bitcoin, they would have 0.00255000.

Over 19.8 million Bitcoins exist—less than 1.2 million remain.

Just 450 new Bitcoins are minted each day.

Roughly 4,500 Bitcoins are bought daily by corporations and institutional investors.

In 2028, only 225 Bitcoin per day will be created.

It will take nearly 40 years to mine the last entire Bitcoin

The Case for Bitcoin: Why Scarcity Matters

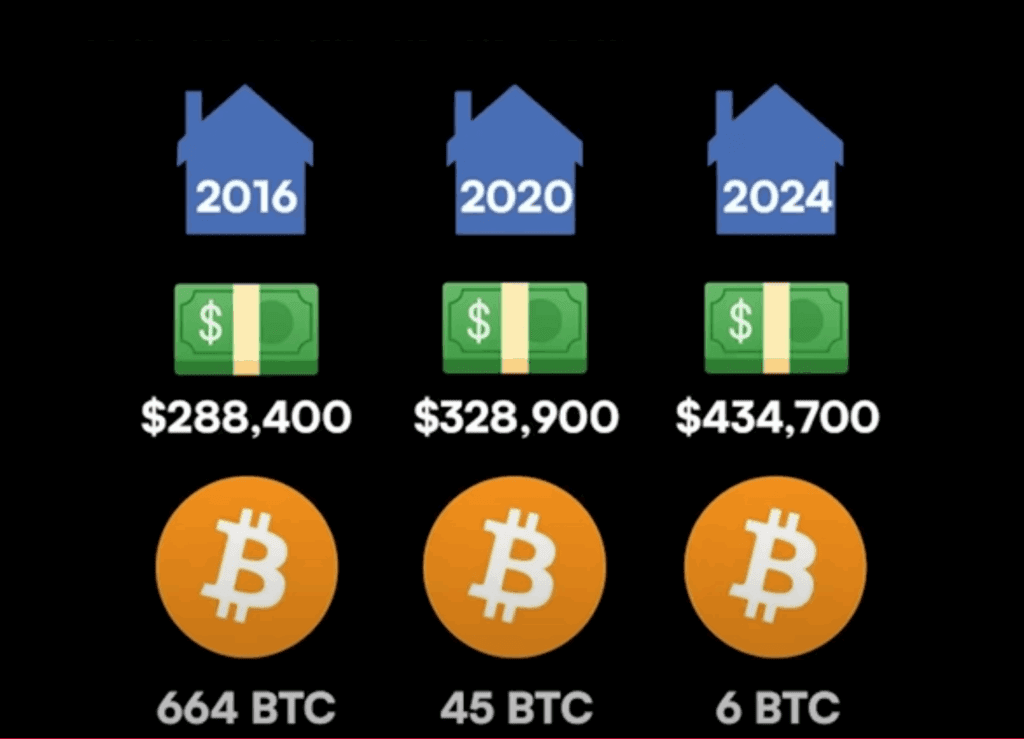

Have you ever stopped to think about how many U.S. dollars have been printed over the past five years? (Hint: hundreds of billions—and it’s rising.) The result? Inflation, which slowly chips away at your purchasing power and your savings.

Bitcoin, on the other hand, was built to be a peer-to-peer payment system—and it does that job incredibly well. But lately, it’s being seen less as a currency and more as a store of value. Why is that? Simple: scarcity, decentralization, resistance to inflation and it does a phenomenal job of doing what it was designed to do. Those qualities have caught the attention of institutional investors and even governments, who now view Bitcoin as a digital reserve asset—much like gold.

Bitcoin is also being treated as an investment. Why? Because its supply is strictly limited and it does a phenomenal job of doing what it was designed to do. In fact, the new supply of Bitcoin is lower than the new supply of both gold and traditional currencies. That hard cap is what makes it so appealing. Major companies have started buying and holding Bitcoin, signaling growing confidence in its long-term potential.

And as Coinbase puts it in one of their commercials—sometimes it takes a fresh perspective to recognize the future.

Security

Andrei Jikh is a finance YouTuber known for his content on investing, personal finance, and cryptocurrency. He gained popularity for his educational videos on Bitcoin and other digital assets, helping viewers understand the fundamentals of crypto investing. Check out the rest of his content on his YouTube channel. (Below is an article from him, on the drone show!)

Adoption

From Tech Circles to Town Halls: America’s Growing Interest in Bitcoin

Bitcoin isn’t just for tech experts anymore. Across the U.S., more people are learning how this digital money works and why it’s getting so much attention. With a limited supply and no central bank in control, many Americans see Bitcoin as a new way to protect their money from inflation—and possibly even grow their savings. Whether you’re hearing about it on the news, from friends, or at your local town hall, Bitcoin is starting to feel a lot more familiar.

As Bitcoin adoption grows across the U.S., states are introducing new legislation to support it. BitcoinLaws.io helps you track these changes—covering proposed bills, passed laws, and everything in between. Whether you’re a citizen, investor, or policymaker, this is your hub for Bitcoin-related legal updates in America.

What others are saying…

Stay up to date on the important “bits”…

Join our email list to receive our newsletter.

Looking for help? Get in touch with us